Building biotech hubs: The Middle East’s biomanufacturing evolution

The current shift in global trade is setting the stage for API-dependent countries like those in the Middle East to rethink their biopharma logistics.

Biomanufacturing in the Middle East has gained strong momentum since 2020, led by strategic moves in the UAE and Saudi Arabia. The UAE partnered with Pfizer to develop local production capabilities, while Saudi Arabia ramped up R&D investments. By 2022, infrastructure initiatives like KEZAD spurred global biotech interest. In 2023, the launch of Lifera CDMO in Saudi and UAE’s expanded alliances with G42 Healthcare and AstraZeneca marked a shift toward localized manufacturing. By 2024, biotech hubs such as Dubai Science Park and DuBiotech further solidified the region’s position as a rising global biomanufacturing destination.

The current shift in global trade is setting the stage for API-dependent countries like those in the Middle East to rethink their biopharma logistics. Middle Eastern nations, especially the UAE and Israel, are heavily reliant on APIs from China, accounting for up to 51% and 37% of their imports, respectively. While these countries may not be directly impacted by tariff changes or geopolitical tension, such developments can still cause ripple effects. This presents an opportunity to reduce API imports dependency by advancing localized, tech-driven biomanufacturing-attracting foreign investments and accelerating regional cooperation.

Government initiatives

Several government initiatives are being enforced in the MENA region with the goal of positioning themselves a biomanufacturing hub, but the focus lies not only on the headlines but also the huge opportunities at stake for the ecosystem. Saudi Arabia’s National Biotechnology Strategy, launched in January 2024, aims to position the region as a global biotech hub by 2030. The Saudi Food and Drug Authority (SFDA) has introduced a strong biosimilar regulatory framework aligned with EMA and FDA guidelines to encourage local production and research collaborations.

Similarly, the UAE’s National Strategy for Pharmaceuticals targets 50% local manufacturing of biosimilars and generics by 2030 and furthermore Oman has also moved toward international compliance by aligning NPRA’s biosimilar regulations to global standards, with a focus on encouraging local production and global partnerships.

As regulatory confusion is reduced due to this, global biopharma companies are now encouraged to implement strategic collaborations, co-develop products in-market and license biosimilar assets. CDMO’S and technology suppliers will meet with high demands for cutting-edge infrastructure, analytical tools, and digital platforms tailored to produce biosimilars. Since these national strategies show strong commitment to biotech, investors will benefit with a de-risked environment for capital deployment.

Companies can employ a multi-pronged strategy such as localizing selectively through tech transfer collaborations or joint ventures; engage early with regulators to shape according to evolving standards; invest in regional R&D and workforce development to support pipeline innovation; and align offerings with national healthcare priorities to enhance their credibility access-driven initiatives and public-private partnerships.

Partnerships and collaborations

Current public-private collaborations in the MENA region are more than mere individual industrial initiatives, they mark the beginning of regional value chain localization, with implications for long-term economic diversification, market access, and resilience. For instance, the Public Investment Fund (PIF) launched Lifera, in 2023 with the objective of expanding the domestic biopharmaceutical industry in Saudi Arabia. In July 2023, Lifera, Sanofi, and Arabio signed a MOU to establish a vaccine manufacturing facility in Saudi Arabia aiming to produce seven vaccines from the national immunization schedule. A similar forward-looking move into precision medicine can be seen in the 2024 partnership between King Fahd Medical City and Boston Oncology to localize gene and targeted cell therapies.

The decision by Boehringer Ingelheim to relocate production of a drug for type 2 diabetes to Alpha Pharma reflects Saudi Arabia's growing capability for cutting-edge therapeutic manufacturing. At the same time, ACDIMA's Biopharmaceutical Plant in Egypt, to start operations shortly and at a cost of EGP 5 billion, will be the first of its kind in the region and will manufacture biologics like vaccines and monoclonal antibodies. Taken together, these developments reflect a deliberate regional shift away from basic fillfinish activities and towards high-value manufacturing. This provides stakeholders with a timely opportunity to assist local initiatives to produce vaccines and high-value biologics locally and leverage favourable government incentives and funding.

Strategically, this biomanufacturing traction brings two advantages: it makes the Middle East an important location in the global biosimilar and advanced therapy value chain while lessening the exposure to geopolitical supply chain threats such as trade tensions between the United States and China. In an evolving regional health economy, investors, biopharma firms, and technology vendors must recognize this transition as an opportunity to transfer technologies, co-develop platforms, and acquire an early-mover benefit.

Improving cancer and diabetes care

Cancer is becoming more prevalent in Saudi. According to the Saudi Cancer Registry thousands of new cancer cases are being recorded annually, where breast, colorectal, thyroid, and lymphoma are the most common types. To address this rising concern several pharma companies such as SaudiVax, Tabuk Pharmaceuticals and SPIMACO, are focusing on local pharmaceuticals manufacturing with potential expansion into biologics.

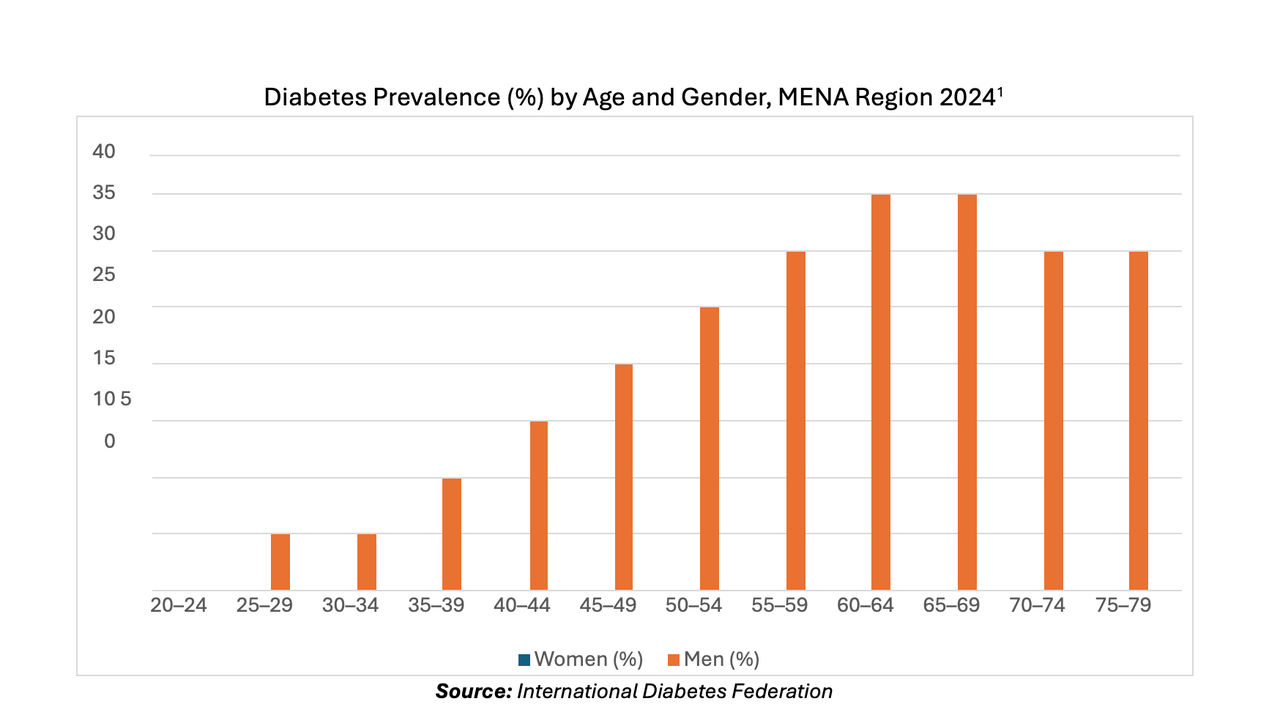

According to 2024 data from the International Diabetes Foundation, the Middle East has the highest regional prevalence of diabetes at about 17.6%. This is expected to increase by 92% with 163 million expected to have the disease by 2050. Several companies are working to address this concern. For instance, Julphar, in UAE, has a biosimilar sector producing recombinant DNA insulin locally supporting diabetes care across MENA region. By developing cost-efficient and accessible treatment options tailored for local population, localized biomanufacturing could enhance the management of conditions like diabetes and cancer.

Middle East countries especially Saudi and UAE are transitioning swiftly by adopting advanced technologies such as AI and 3D printing with companies like G42 Healthcare and Evogene that are leveraging AI for drug development. Furthermore, Biosapien, with operations in Abu Dhabi, is planning to launch the clinical trials for it’s for MediChip, a 3D biodegradable implant targeting cancer, in the UAE. These developments will position the Middle East as an important part of global health transformation by contributing towards non-oil GDP, embracing sustainability and fostering high-quality job opportunities.

Outlook

The MENA region, led by Saudi Arabia and the UAE, is expected to transition from an early-stage infrastructure buildout to a globally competitive biomanufacturing hub within the next three to five years. The area is attracting investment because of its positive fiscal regimes, including a 0% corporate tax, VAT relief, and customs relief, as well as cutting-edge logistics and tech infrastructure. This is driving the transition from import-reliance to export-oriented life sciences manufacturing. More than 450 multinational corporations, including Pfizer, AstraZeneca, Zimmer Biomet, and GE Healthcare, have operations in free zones such as Dubai Science Park and Saudi Arabia's Special Economic Zones (SEZs).

Fostering interoperable frameworks that attract international clinical trials and GMP-compliant production should be at the top of regulators' agendas in the future. Startups and health tech firms can capitalize by embedding AI, 3D printing, and sustainable design into localized production models. Investors should be on the lookout for emerging digital supply chain platforms, contract development and manufacturing organizations (CDMOs), and local precision medicine centres of excellence. By 2030, the Middle East could be a global top exporter of biosimilars and emerging treatments, shifting health sovereignty and becoming a corner stone for regional post-oil economic diversification if momentum continues and regional coordination is enhanced.